Efficient Solutions

Apply seamlessly with just one required document

Apply seamlessly with just one required document

We prioritize data privacy and provide support exactly when you need it

Benefit from instant fund transfers and a variety of flexible loan options

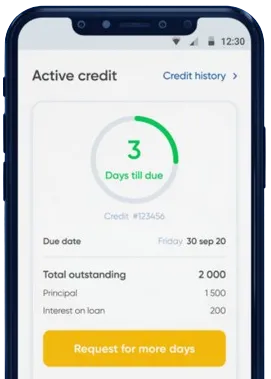

Effortlessly complete the application form directly within our app.

Await our prompt approval—most decisions are made within just 15 minutes.

Enjoy swift fund deposits, typically it takes only minutes.

| Option | Loan Amount | Interest Rate | Fee | APR Range |

|---|---|---|---|---|

| Option 1 | KES 7,000 | 5% | 3% | 0% - 36% |

| Option 2 | KES 20,000 | 7% | 4% | 0% - 36% |

| Option 3 | KES 50,000 | 10% | 6% | 0% - 36% |

| Option 4 | KES 200,000 | 12% | 8% | 0% - 36% |

| Option 5 | KES 350,000 | 15% | 10% | 0% - 36% |

In today's fast-paced world, unexpected expenses can arise at any moment, leaving individuals and businesses in urgent need of funds. Whether it's covering medical emergencies, repairing a vehicle, managing sudden business costs, or handling other unforeseen expenses, having access to quick and reliable financial solutions is essential. Mini loans, particularly the KES 10,000 options available online, have become increasingly popular in Kenya, offering swift and flexible support tailored to meet immediate financial needs.

Understanding mini loans is crucial for anyone thinking "I need money urgently". Mini loans are small, short-term loans designed to provide quick access to funds with minimal hassle. Unlike traditional bank loans, which often involve lengthy approval processes and extensive paperwork, mini loans prioritize speed and simplicity. This makes them an ideal choice for urgent financial needs, allowing borrowers to receive funds within hours or days.

Mini loans typically come with varying interest rates and repayment terms, making them adaptable to different financial situations. For example, a KES 1,000 loan might have an interest rate of 5% over 61 days, while a KES 10,000 loan could offer a 12% interest rate over a year. These flexible terms ensure that borrowers can choose a loan that aligns with their financial capacity and repayment ability.

Obtaining an urgent cash loan in Kenya is a streamlined process designed to provide quick financial relief. Here’s how you can navigate the application efficiently:

Mini loans offer numerous benefits that make them an attractive option for those in need of immediate financial assistance:

Having access to mini loans can significantly enhance your financial stability, especially during emergencies. By providing a quick source of funds, these loans help you manage unexpected expenses without disrupting your daily life or business operations. Additionally, having a fast loan option available serves as a financial safety net, ensuring that you are prepared for unforeseen circumstances.

Regularly having access to mini loans can help you build a financial safety net, reducing the stress associated with unexpected financial challenges. This preparedness allows you to handle emergencies more effectively, providing peace of mind and financial security. For businesses, mini loans can be instrumental in maintaining operations during cash flow shortages or unexpected expenses. Quick access to funds ensures that your business can continue to function smoothly, preventing disruptions that could impact your bottom line.

While mini loans are widely available, the urgent loan 10,000 in Kenya stands out as a crucial financial tool for many individuals and businesses facing unexpected challenges. These loans provide the necessary funds to navigate emergencies, ensuring that financial stability is maintained even during turbulent times. One of the primary benefits of an urgent loan 10 000 in Kenya is the convenience and speed at which it can be obtained. Traditional bank loans can take weeks to process, while mini loans can be approved and disbursed within hours or days. This makes them ideal for situations where quick access to cash is essential.

Mini loans in Kenya are available to a wide range of borrowers, including individuals with poor credit scores or limited collateral. This accessibility ensures that more people can benefit from quick financial support when they need it most. Additionally, mini loans can be used for various purposes, including medical expenses, education fees, business capital, or unexpected emergencies. Borrowers have the flexibility to use the funds as needed, without restrictions on how the money is spent.

For those in Kenya wondering, "where can I borrow money urgently in Kenya?", the answer lies in the growing number of online lenders offering 10,000 loan online options. These platforms provide a seamless application process, often accessible via mobile devices, ensuring that borrowers can secure funds anytime and anywhere. The convenience of these loans, combined with the ease of online applications, makes them an ideal choice for those in urgent need of financial assistance. With just a few clicks, you can have funds transferred directly to your bank account, allowing you to cover emergency expenses without delay.

Whether you're dealing with a personal crisis or managing business needs, knowing where to borrow money urgently in Kenya can make all the difference. Reputable online lenders not only provide quick access to funds but also ensure that the borrowing process is secure and transparent, protecting your personal and financial information.

When you find yourself thinking, "I need money urgently," turning to mini loans can be a practical solution. These loans offer the immediate financial relief you need without the prolonged wait times associated with traditional lending institutions. Whether it's for personal emergencies, such as medical bills or unexpected home repairs, or for business needs like covering operational costs or investing in new opportunities, having access to instant cash loans ensures that you can handle unexpected financial challenges efficiently and effectively.

Mini loans cater to a diverse range of financial needs, providing flexibility and support when it's needed most. The ability to quickly secure funds can prevent minor financial hiccups from escalating into major problems, helping you maintain stability and focus on what truly matters.

Securing a 10,000 loan online is a straightforward process, designed with speed and convenience in mind. With the right platform, applying and receiving approval can take just a few minutes, eliminating lengthy paperwork and extensive waiting times. Here's a simple breakdown of how it works:

By leveraging online platforms, borrowers can access funds quickly and efficiently, ensuring that financial emergencies are managed without unnecessary delays.

Mini loans, particularly the KES 10,000 options available online, offer a practical and efficient solution for managing immediate financial needs in Kenya. With their speed, convenience, and flexibility, these loans provide essential support during emergencies, helping individuals and businesses navigate unexpected financial challenges with ease. By understanding the application process, advantages, and key considerations, you can make informed decisions and secure the financial assistance you need swiftly and securely.

Whether you’re in Kenya seeking an urgent loan 10 000 or looking for a mini loan 10,000, these financial products empower you to handle life’s unexpected challenges confidently and efficiently. Explore the various options available today and discover how mini loans can enhance your financial stability and support your goals.

Mini loan 10,000 in Kenya are short-term financial products designed to provide borrowers with quick access to funds. These loans are typically processed within a few hours or days and are intended to address urgent financial needs such as medical emergencies, vehicle repairs, or unexpected business expenses. The streamlined application process and minimal documentation requirements make mini loans 10,000 an attractive option for those seeking immediate financial assistance.

To apply for a fast loan in Kenya, you can visit the website of a reputable lender or use their mobile application. The application process typically involves filling out an online form with your personal and financial details, submitting necessary documents such as identification and proof of income, and then awaiting approval. Many lenders offer instant approval decisions, allowing you to receive the funds directly into your bank account within minutes.

The eligibility criteria for mini loan 10,000 in Kenya generally include being a Kenyan citizen or resident, being at least 18 years old, having a steady source of income, and possessing a valid form of identification. Additionally, lenders may require proof of address and a functioning bank account. Some lenders may also consider your credit history, although many are willing to work with individuals who have less-than-perfect credit scores.

The amount you can borrow with a fast loan in Kenya varies depending on the lender, your income, and your creditworthiness. Typically, lenders offer mini loans ranging from KES 1,000 to KES 100,000 or more. The specific loan amount you qualify for will depend on your financial situation and the lender's policies.

The interest rates for mini loan 10,000 in Kenya vary based on the lender and the loan amount. Generally, these rates are higher than those for traditional bank loans due to the expedited processing and higher risk involved. Interest rates can range from 5% to 20% or more, depending on the lender's policies and the borrower's credit profile.

Most lenders of mini loan 10,000 in Kenya disburse the funds within 24 hours of approving the loan application. Some lenders even offer instant disbursement of funds, allowing borrowers to receive the money within minutes of approval. This quick turnaround time makes mini loans an excellent option for addressing urgent financial needs.